Choosing a CDMO for mRNA success: Five CDMO characteristics needed

Category | Advanced therapy

The promise of mRNA technologies has been clearly demonstrated during the COVID-19 pandemic, with vaccines reaching the market in record time. The vital role of contract development and manufacturing organizations (CDMOs) during this time will have a lasting impact on their relationships with pharmaceutical companies. CDMOs with pandemic-related experience in mRNA vaccine development, manufacturing, and supply chain logistics will bring particular benefits to their pharma partners. Pandemic learnings taught CDMOs on how best to support pharma companies’ efforts to develop and deliver drugs to patients.

What to look for as COVID-19 transitions to the endemic phase

During the pandemic, as COVID-19 vaccines and therapeutics rolled out worldwide, demand for CDMO services increased sharply, and relationships with pharma companies evolved. In a post-pandemic future, the most successful pharma-CDMO relationships will likely share five key characteristics:

- Strategic partnerships, with CDMOs fully leveraging their expertise and resources to build a deep understanding of the supply chain and the manufacturing risks that pharma companies face to ultimately develop differentiating capabilities that fill these gaps. This will advance the partnership model and create new opportunities for CDMOs in a more central role.

- High quality standards, verified by audits, with CDMOs refusing to sacrifice quality for speed, adhering to excellent standards as a non-negotiable, and leveraging COVID-19 vaccine production experience to provide business agility to their pharma partners.

- Responsiveness to supply and demand, ensuring that the CDMO continues to add value and successfully navigate changing market dynamics. Before the pandemic, pharma-CDMO relationships were largely transactional. When pharma companies required additional capacity or access to a new technology, CDMOs were engaged, often under a fee-for-service or project-based contracting model. The pandemic has significantly changed this landscape.

- Localized supply if needed, as was the case during the pandemic, governments and Non-Governmental Organizations (NGOs) funded development and production of new COVID-19 vaccines and therapeutics. Going forward, CDMOs will need a detailed understanding of their own capabilities and customer vulnerabilities. This means assessing pharma capacity and capability needs in light of potential supply chain disruptions, geopolitical considerations, and the competitive landscape. CDMOs also need to adopt a forward-looking view of capacity planning.

- Broad service offerings, CDMOs that can facilitate mRNA vaccine development with full-service solutions (e.g. from raw material supply up to final distribution) offer pharmaceutical partners the assurance of in-house scientific, manufacturing, and logistics expertise; and the reliability of tightly controlled processes, coordinated networks of facilities, and high-level quality oversight.

Challenges tackled during the pandemic

Advancing mRNA vaccines from laboratory to clinic has demanded unique solutions to complex and evolving challenges. The urgent need for rapid advances during the pandemic resulted in fast and unprecedented innovation in vaccine formulation, development planning, and supply chain logistics. The demand for deep expertise and immediate capacity required proven supplier networks and established facilities to coordinate a swift and successful scale-up.

Progress was achieved through collaborations between pharmaceutical companies and strategic CDMO partners that were able to provide end-to end support including mRNA manufacturing capabilities, raw material supply for nucleotides and enzymes, cell banking, plasmid manufacturing, mRNA synthesis through in vitro transcription, lipid nanoparticle encapsulation, fill and finish, and packaging and transportation services. CDMOs offering full-service solutions were able to provide pharmaceutical partners with the assurance of in-house scientific, manufacturing, and logistics expertise, the reliability of tightly controlled processes, coordinated networks of facilities and high-level quality oversight.

Key success factors for mRNA vaccines

To rise to the challenge of mRNA vaccine development and supply, pharma companies should identify a CDMO partner that:

- Understands the unique attributes of mRNA vaccine development

- Prioritizes flexibility of manufacturing capabilities to adapt to shifting clinical requirements

- Has insight into global vaccine supply chain implications and how to navigate them

- Embraces new technology advancements and digitalization as next step for the future

- Identifies integrated solutions that link each phase of the mRNA journey

A critical challenge for raw materials is the need for safety and purity based on regulatory guidelines for products for human use. Raw materials must be free of substances of animal origin, and of beta lactam antibiotics, to eliminate risks of transmissible diseases or viral agents, and risks of allergic reactions and other side effects. Raw material purity is ensured through bioburden and endotoxin testing—and through use of controlled environment, mature quality systems, and extensive quality control testing.

Overall project success depends on selecting the proper quality grade of reagents, identifying appropriate tests to monitor the quality of each intermediate, and selecting the most appropriate formulation, which may include lipid nanoparticle manufacturing. This ensures the lot-to-lot consistency required by industry and global regulatory authorities alike.

To meet this challenge, Thermo Fisher Scientific launched its TheraPure and TheraPure Plus solutions for mRNA production. These are designed to accelerate mRNA vaccine and therapeutics production from preclinical development to commercialization with a portfolio of restriction enzymes, in vitro transcription enzymes, nucleotides, and capping solutions to meet critical process, scale, quality, and regulatory needs. These raw materials are crafted in facilities with thoroughly documented quality systems that are audited by accredited registrars and are manufactured following GMP principles.

Over the past year, the lack of a mature supply chain for mRNA has posed challenges for vaccine production, with the industry moving from manufacturing thousands to billions of doses—a scale-up that would stress any system. Key vendors are working diligently with suppliers to create and scale up manufacture of raw materials such as lipids, enzymes, and resins for purification. Supply is currently a challenge for any vaccine modality, including for simple components such as tubing or filters.

Thermo Fisher Scientific is supporting customers in this space by rapidly expanding capacity for resin production, adding capacity to an existing facility and accelerating build-out of a new facility to double overall production. In 2020, we built a new facility in Vilnius, Lithuania, for industrial-scale single use technology manufacturing. We have manufacturing redundancies in several U.S. locations for reagents used in mRNA synthesis, with the goal of ensuring a stable supply that is accessible from multiple sites on different continents.

An additional challenge is the need for a skilled workforce. Each vaccine is developed, produced, and tested by highly technically skilled people. It has been challenging to find enough people to support the rapid build out in manufacturing, analytics, manufacturing science and technology (MST), tech transfer and chemistry, and manufacturing and controls (CMC). Partnerships with pharma companies should comprise cross-functional teams including raw material developers, process equipment suppliers, analytical experts, formulation scientists, clinical study leaders, and quality compliance advisors.

Capacity has been the primary hurdle for DNA and plasmid production, which mainly uses fermentation, typically with E. coli. Suite dedication is a particular issue, since carrying out a fermentation process in a suite that also runs a mammalian cell culture would lead to a risk of cross contamination. Overall, the plasmid production process is straightforward, starting with fermentation, harvest/lysis/concentration, purification, and formulation. This usually employs a fermenter less than 100 liters in capacity, with relatively small columns of up to 20 liters. For customers with controlled clean space to implement their own plasmid production, we offer Gibco™ fermentation media, single-use fermenters and POROS™ anion exchange and hydrophobic interaction resins.

mRNA vaccine development: Evolving and here to stay

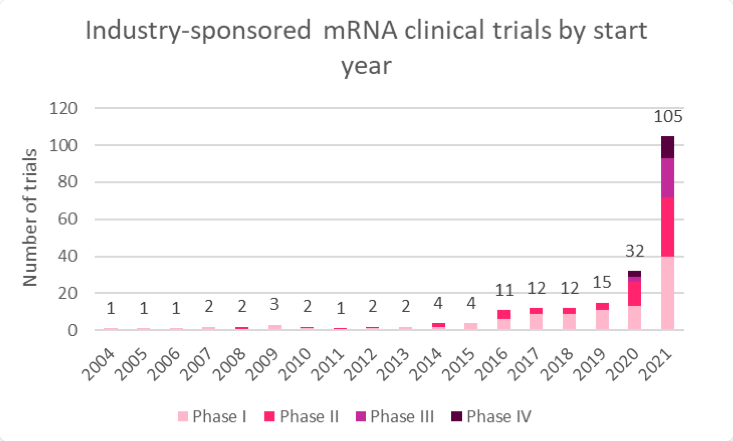

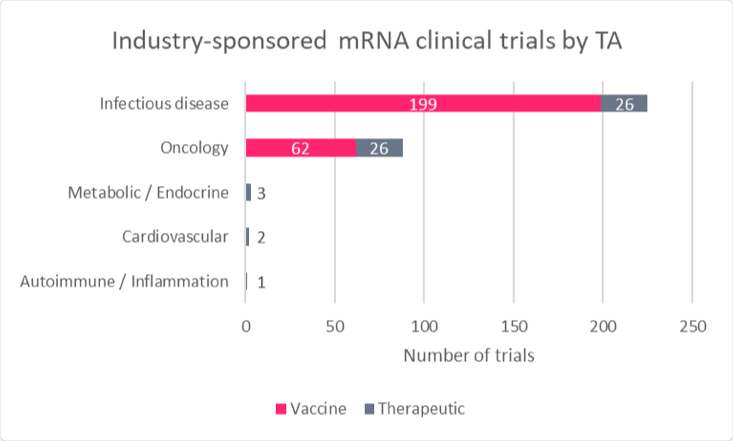

Since the pandemic began, mRNA-related clinical development has swiftly pivoted toward infectious disease vaccines, with more than 200 industry-sponsored studies underway (Figures 1 and 2). Multiple late-stage trials are in progress, expanding the breadth of understanding of the platform technology. However, despite hundreds of millions of doses administered, mRNA technology remains nascent; out of 218 assets in total, 75% (164) are still in preclinical development. The two vaccines from Moderna and BioNTech account for virtually all clinical experience and validation of mRNA technology against SARS-CoV-2. Current clinical-stage mRNA projects primarily span infectious diseases and oncology, with an emphasis on vaccines ahead of therapeutics.

Figure 1: Ongoing industry studies involving mRNA by therapeutic area

Source: Trialtrove (May 2022)

Figure 2: Industry studies involving mRNA by start year

Source: Trialtrove (May 2022)

Ongoing platform developments reflect the fact that first-generation products have surpassed expectations. The mRNA platform has clearly demonstrated superiority over traditional platforms in terms of pandemic response, high speed and success rates in development, competitive clinical profiles, successful scale-up of manufacture, and adaptability to rapidly modify antigen sequence.

The acceleration of mRNA-based approaches has required a collaborative effort, with R&D alliances dating back to 2013 driving the technology. COVID-19-related advances have triggered significant recent deal-making activity, including broad R&D alliances that are making way for manufacturing and commercial partnerships. These investments will have a broad legacy in advancing non-pandemic opportunities and next-generation platform improvements.

Clearly, a major driver for these alliances is the sales potential of the resulting vaccine and drug candidates: Record-breaking revenues are aiding long-term platform investment, with COVID-19 vaccines forecast to be among the best-selling products of all time. This sales opportunity will likely be durable, as governments are indicating a preference for mRNA technology to conclude initial vaccine programs and booster shots in response to the endemic phase.

Future development efforts may overcome some competitive weaknesses and improve competitiveness in non-pandemic settings. Examples include multivalent next-generation vaccines, products that are lyophilized for thermostability, self-amplifying mRNA to yield a lower effective dose or reduce the need for boosters, and the excess manufacturing footprint that may exist post-COVID.

Looking ahead, this promising technology will continue to build on pandemic vaccine success to create multiple untapped opportunities. Considerable partnering activity has been required to progress mRNA platforms and manufacturing capabilities, and this has unlocked tremendous commercial potential and record-breaking revenues. Investments will have broad legacy in advancing non-pandemic opportunities and next-generation platform improvements. Outside of COVID-19, areas of opportunity for mRNA include:

Looking ahead, this promising technology will continue to build on pandemic vaccine success to create multiple untapped opportunities. Considerable partnering activity has been required to progress mRNA platforms and manufacturing capabilities, and this has unlocked tremendous commercial potential and record-breaking revenues. Investments will have broad legacy in advancing non-pandemic opportunities and next-generation platform improvements. Outside of COVID-19, areas of opportunity for mRNA include:

- Vaccines against other infectious diseases

- Non-vaccine therapeutics,

- Cancer vaccines,

CDMOs that built experience during pandemic materials shortages and transportation shutdowns are especially well-suited to lead streamlined vaccine development and manufacturing for the next generation of mRNA vaccines and therapeutics.

View references