Unlocking the future of pharma: Key Insights from CPHI Barcelona 2023

Category | CDMO Services

As the largest global event for pharmaceutical supply chain companies, CPHI is a microcosm of the pharmaceutical manufacturing industry.

At this year’s event in Barcelona, the changing competitive environment was palpable. Fueled by advances in technology and biomedical science, along with unprecedented global, political, and economic forces, the rapidly shifting pharma landscape contributed to an undercurrent of urgency and a growing consensus that innovation, adaptation, and strategic collaboration are essential for progress.

Following are some of the key takeaways from the conference.

- CDMO partnership dynamics are changing. The growing complexity of novel therapies, supply chain uncertainties, increased competition, intensified regulatory scrutiny, and compressed timelines demand new ways of working to guarantee product safety and quality without compromising innovation and development speed.

To keep pace with the complex and dynamic pharma environment, high-performing CDMOs are embracing innovation, focusing on agility and scalability, forming strategic alliances, and actively participating in shaping the future of pharmaceutical manufacturing.

This message was underscored by Anil Kane, PhD, Senior Director of Global Technical Scientific Affairs at Thermo Fisher Scientific, in his presentation, “CDMO 2.0: Uncovering the Missing Element in Next-Generation Pharma Partnerships,” delivered as part of the Partnering for Success track. He described the increasing expectation for CDMOs not only to offer access to cutting-edge technologies but also to provide the critical insights necessary to harness these advancements effectively.

The ability to quickly and efficiently adapt production processes to accommodate varying product types, volumes, and customer demands is a valuable differentiator, he explained.

Achieving this degree of agility requires integrating robust supply chain management with advancements in process automation, continuous manufacturing, data analytics, and predictive modeling, as well as regulatory expertise and workforce development, he explained. It is also facilitated by an unwavering commitment to product, process, and partnership quality.

- Personalization is the new industry watchword. An evolution of patient-centric drug development, personalization in pharma manufacturing refers to the creation of medications that are tailored to the individual characteristics of each patient, often at a genetic level, adding layers of complexity to the manufacturing process.

To address the needs of personalization, there has been a paradigm shift in pharmaceutical production and a considerable expansion of the roles played by outsourcing partners that bring the right skills to the table. Some of the must-have characteristics include:

- The expertise and capability to manage small and variable batch production while maintaining rigorous quality standards

- Flexible manufacturing processes that can be quickly altered to produce different personalized medications

- The ability to handle complex data and provide advanced analytics to support the customization of treatments

- Flexible supply chains to swiftly adapt to patient-specific manufacturing needs

- The agility and global regulatory experience to navigate the rapidly changing landscape

- A robust continuum of services from early-stage development through full-scale production to provide a more cohesive, efficient, and effective development and commercialization pathway

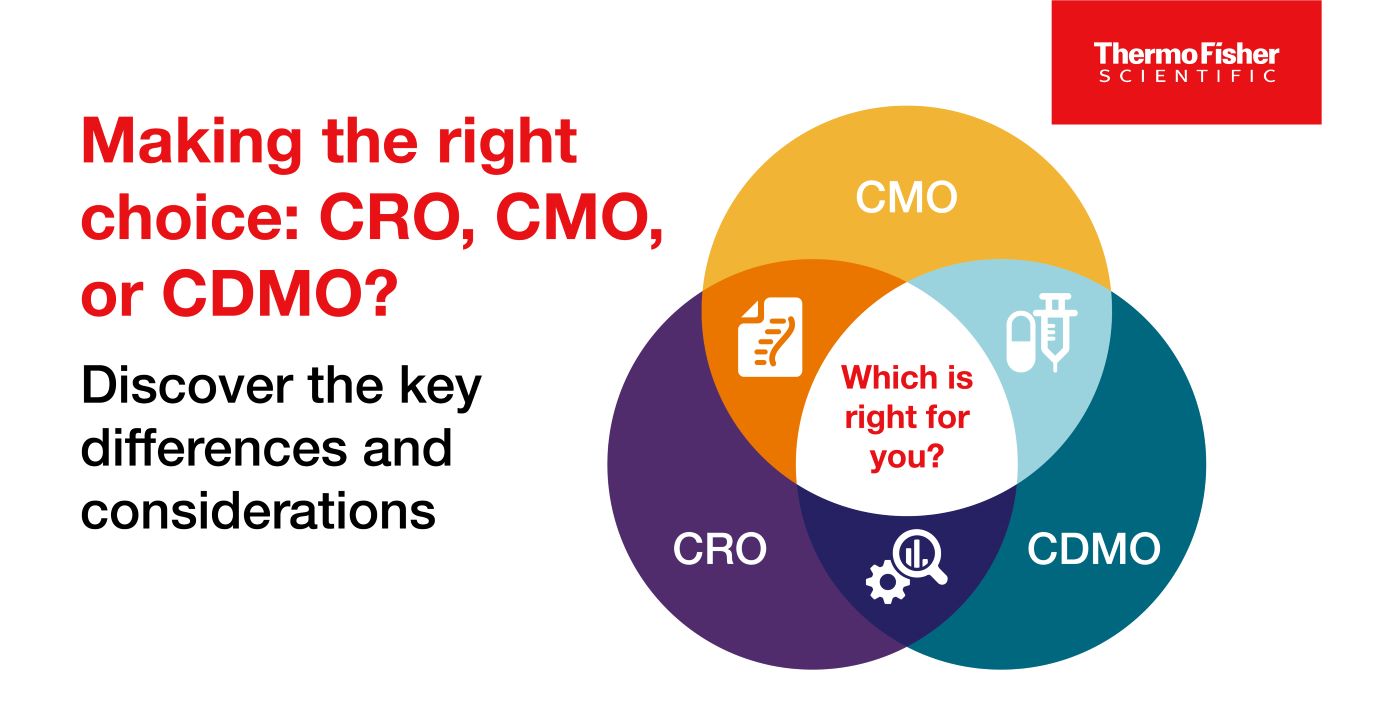

- The concept of end-to-end support is evolving. The promise of end-to-end services has been a familiar refrain at CPHI for a number of years. ,. In today’s context, “end-to-end” encompasses far more than a simple menu of services; it signifies the strategic integration of drug discovery, clinical trials, regulatory compliance, manufacturing, marketing, and post-market surveillance under one umbrella. One manifestation of this is the integration of CRO and CDMO services as described in this year’s CPHI Trend Report.

The ability to provide partners with integrated CRO and CDMO services facilitates seamless transitions between phases of development, reduces time to market, and ensures consistent quality control throughout the lifecycle of the drug. By leveraging the advanced technologies and data analytics capabilities of partners that provide fully integrated services, companies can optimize their operations, predict market trends, and personalize medicine to meet the precise needs of patients, while staying agile in a competitive landscape.

- Fill-finish services for injectables are in high demand. The surge in demand, particularly for specialized dosage forms such as prefilled syringes, cartridges, and lyophilized products, is largely driven by the increased complexity and diversity of pharmaceuticals requiring parenteral delivery, higher bioavailability of injectables, emerging markets, and changing patient needs, according to Christy Eatmon, Thermo Fisher Global SME for Sterile Drug Product.

Additional drivers are the expanded use of home delivery of medications to patients for self-administration and the increase in the number of companies changing the delivery format of their sterile injectable therapies—from liquid vials to prefilled syringes, for example—for improved lifecycle management.

The connection between sterile fill-finish capabilities and next-generation biomanufacturing was a common topic of discussion. Advanced aseptic processing facilities enable the safe, efficient, and compliant delivery of innovative therapies, and as biomanufacturing evolves, the role of sophisticated fill-finish operations will become even more critical in bridging the gap between laboratory breakthroughs and accessible patient treatments.

- Sustainability matters. Most pharmaceutical executives expect sustainability performance will soon be included in pharma manufacturing contracts, according to findings published in the 2023 CPHI Annual Report, which was released in conjunction with the conference.

Approximately 80% of the executives from the 250 global pharma companies surveyed for the report believed sustainability metrics and goals will be integrated into contracts within two years, and 93% felt that visibility into supply chain partners’ sustainability record was important or extremely important.

Meeting the industry expectations requires a significant commitment and value-adding investments. For insight into what this looks like in the pharma and biotech sectors, download our recent sustainability eBook.

Certainly, these highlights are just the tip of the iceberg, given the size and scope of CPHI Barcelona 2023. One consideration not included on this list is artificial intelligence (AI). While AI was a frequent topic of conversation, the presentations and discussions were still largely focused on future expectations. In fact, most executives surveyed for the CPHI annual report expressed confidence that AI will be a major force evolving the pharma landscape over the next 5 years.

This has important implications for outsourcing partners, Thermo Fisher’s Anil Kane explained. “There is interest in applying AI into every aspect of drug development, from discovery to clinical trials and supply chain,” he said. “It is up to us, as strategic partners to our customers, to find the right applications, evaluate value added outcomes, and justify the use of these techniques in the right areas.”

Explore our capabilities to learn more about the advancements and innovations that are moving pharmaceutical manufacturing forward.